The Abu Dhabi Commercial Bank (commonly known as ADCB) is a leading bank in the United Arab Emirates, founded in 1985 and headquartered in Abu Dhabi. It is the UAE’s third largest bank, providing its valued customers with retail banking, commercial banking, Islamic banking, and other financial services.

Abu Dhabi Commercial Bank (ADCB) provides a variety of traditional and Islamic credit cards, each with its own set of rewards and perks. ADCB offers a variety of cards, ranging from fee-free to reward-based.

The cards are designed to meet the financial needs and requirements of a wide range of credit card applicants. ADCB’s credit cards come with a variety of exclusive bonuses, features, and incentives.

To meet the fundamental financial needs of individual applicants, the bank offers both conventional and Islamic credit cards. Using the ADCB credit card may be a genuinely gratifying experience for the credit card applicant.

ADCB Credit Card Eligibility Criteria

Applying for an ADCB credit card is not difficult provided the candidate satisfies the ADCB credit card eligibility standards. Some of the elements that go into determining whether or not an application is qualified for an ADCB credit card are as follows:

- To apply for an ADCB card, the applicant must be between the ages of 21 and 65 years old.

- Each ADCB Credit Card has a minimum monthly income requirement. It implies that the applicant has a consistent source of income. To be eligible for ADCB credit cards, they must show proof of a consistent monthly income.

- To complete the credit card application, you must have a legitimate residential address.

- Regardless of how wonderful your monthly pay check is, if you have a bad credit history, you may be denied a credit card. That is why, in order to obtain an ADCB credit card, you must have a strong credit history.

Documentation Required for an ADCB Credit Card Application

The following documents are necessary to complete the ADCB credit card application:

- Emirates ID

- Salary Certificate

- 3 to 6 months’ bank statements

- Passport (For expats)

- Visa for residency in the UAE (For expats)

- Proofs of Address (such as utility bills)

- A business licence (for self-employed individuals)

How and where to apply for an ADCB Credits Card?

The person can apply for an ADCB Credit Card by simply visiting any bank branch, completing an online credit card application, or through your phone.

Visit to a Bank

The applicant may also apply for an ADCB credit card by going to the local bank office and filling out an application for the credit card that best meets their needs. In the credit card application form, the applicant must fill in all of the basic information. Their credit card application will be processed if they match the eligibility conditions set out by the bank.

Banking over the phone

By calling the bank’s official number, the applicant can also apply for an ADCB credit card.

Online

Applicants can go to the ADCB official website’s credit cards page to learn more about the credit card’s features, perks, and criteria, and then choose the credit card that best meets their financial needs and requirements. They may apply for a credit card by clicking the apply button, filling out the needed information, and submitting their application. The bank personnel will check the legitimacy of the submitted information once all of the data have been filled in. They will assess whether or not the application is eligible for a credit card based on the applicant’s eligibility requirements.

Types of ADBC Credit Cards

To understand better we divided credit cards into different categories. Following are the cards offered by ADCB:

Etihad Guest Miles Credit Cards

- ADCB Etihad Guest Infinite Credit Card

- ADCB Etihad Guest Signature Credit Card

- ADCB Etihad Guest Platinum Credit Card

Touch Points Credit Cards

- ADCB Touchpoints Infinite Credit Card

- ADCB Touchpoints Platinum Credit Card

- ADCB Touchpoints Titanium/Gold Credit Card

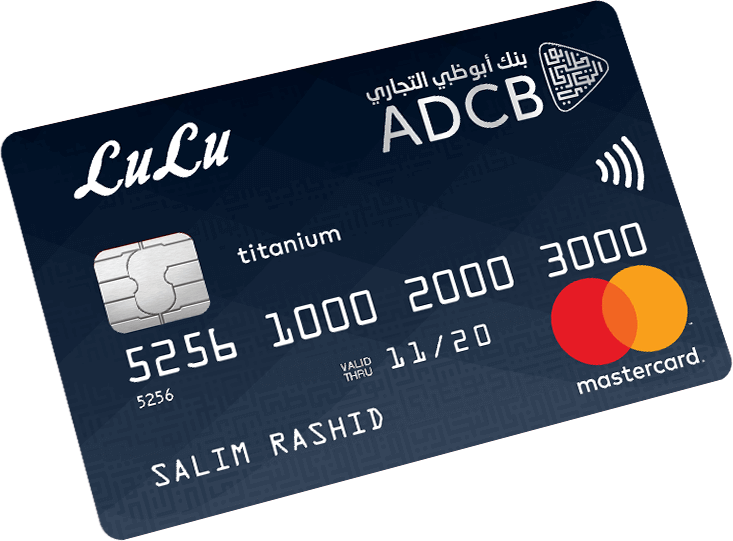

Lulu Points Credit Cards

- ADCB LuLu Platinum Credit Card

- ADCB LuLu Titanium Credit Card

Credit Card for UAE Nationals

- ADCB Betaqti Credit Card

Travel Discounts Credit Card

- ADCB Traveler Credit Card

Detailed features of each ADCB Credit Card

Etihad Guest Miles Credit Cards

ADCB Etihad Guest Infinite Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 2625 |

| Minimum Salary | AED 40,000 |

| FX Rate | 2.99% |

Features & Benefits

- Sign-up bonus: The ADCB Etihad Guest Infinite Card comes with a sign-up bonus of 60,000 Etihad Guest Miles.

- Monthly Incentive: When cardholders make monthly expenditures of USD 5,000 or more, they will earn 5,000 Etihad Guest Miles as a monthly bonus.

- Tier Miles: When using this credit card to make purchases, the cardholder can earn Tier Miles. For every dollar spent on qualified purchases, both domestic and international, they can earn one Etihad Guest Tier mile.

- Etihad Guest Miles: For local transactions, the cardholder can earn 2 Etihad Guest Miles. They also earn 3 Etihad Guest Miles when they use the card for Etihad Airways transactions as well as international transactions.

- Travel benefits: Members of this credit card may take advantage of a variety of travel benefits, including:

- Membership in the Etihad Guest Gold Tier

- A maximum of four free flight upgrade coupons are available.

- Careem provides complimentary airport chauffeur trips.

- There are over 1,000 airport lounges where you may get free entry.

- On Agoda reservations, you may get up to a 12% discount.

- Hotels.com is offering an 8% discount.

- Visa’s luxury hotel selection has a number of advantages.

- Travel insurance for multiple travels

- Lifestyle Advantages: The following are some of the top lifestyle benefits offered by this ADCB credit card:

- Free golf at some of the UAE’s most prestigious golf courses.

- Caribou Coffee is offering a buy one, get one free deal.

- MENA app provides a variety of 2 for 1 deal.

- Yas Island Adventure Parks provides exclusive deals and benefits.

- A maximum of 30% off at over 1400 restaurants in the UAE, as well as unique shopping, travel, and entertainment deals.

- Concierge service available 24 hours a day, 7 days a week, all over the world

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their cell phones.

- Minimum Payment Due: Every month, the card holder can pay as little as 5% of the outstanding balance. They can defer the unpaid money to the following month’s billing cycle.

- Credit Card Shield (Takaful): This ADCB credit card protects the cardholder in the event of a serious sickness or permanent incapacity, involuntary job loss, or natural death. To be eligible for these benefits, the cardholder must participate in the Takaful programme and pay a monthly fee of 1.0395 percent of the total outstanding balance. The maximum amount of coverage available is AED 200,000.

- Misuse Protection: The cardholder can safeguard their card from fraudulent or illegal transactions, as well as illegal third-party usage.

- Purchase Protection: The cardholder is entitled to free purchase protection on items purchased with this ADCB Credit Card, which is valid for 90 days from the date of purchase. It protects you against the loss or theft of your belongings, as well as accidental damage.

- Extended Warranty: On different items purchased with this credit card, the card holder can get an extended manufacturer’s or retailer’s warranty for up to a year.

- Easy Instalments: With this ADCB Credit Card, users may break their transactions into a simple zero percent profit payment plan that lasts for 24 months (maximum).

- Amount Transfers: Cardholders can effortlessly transfer their outstanding balance from another bank’s credit card to this ADCB credit card without incurring any interest.

- Credit Card Loan: With this ADCB credit card, the cardholder can use a pay order to receive cash against their available credit limit. They can pay back the money in convenient instalments over a period of up to 24 months.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days.

ADCB Etihad Guest Signature Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 1050 |

| Minimum Salary | AED 20,000 |

| FX Rate | 2.99% |

Features & Benefits

- Sign-up Incentive: The ADCB Etihad Guest Signature Credit Card gives 35,000 Etihad Guest as a sign-up incentive throughout the first year of card membership.

- Etihad Guest Miles: For local transactions, the cardholder can earn 1.25 Etihad Guest Miles. They also earn 2 Etihad Guest Miles when they use the card for Etihad Airways transactions as well as international transactions.

- Monthly Incentive: When cardholders make monthly expenditures of USD 2,000 or more, they will earn 2,000 Etihad Guest Miles as a monthly bonus.

- Tier Miles: When using this credit card to make purchases, the cardholder can earn Tier Miles. For every dollar spent on qualified purchases, both domestic and international, they can earn one Etihad Guest Tier mile.

- Travel Bonus: Members of this credit card may take advantage of a variety of travel benefits, including:

- Silver Tier Membership with Etihad Guest

- A maximum of two free flight upgrade coupons are available.

- Careem provides complimentary airport chauffeur trips.

- There are over 1000 airport lounges where you may get free entry.

- On Agoda reservations, you may get up to a 12% discount.

- Hotels.com offers an 8% discount.

- Visa’s luxury hotel selection has a number of advantages.

- Travel insurance for many trips

- Lifestyle Advantages: The following are some of the top lifestyle benefits offered by this ADCB credit card:

- Free golf at some of the best courses in the country.

- MENA app provides a variety of 2 for 1 deal.

- Yas Island Adventure Parks provides exclusive deals and benefits.

- A maximum of 30% off at over 1400 restaurants in the UAE, as well as amazing discounts on shopping, travel, as well as amusement

- Concierge service available 24 hours a day, 7 days a week, all over the world

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Minimum Payment Due: Every month, the cardholder can pay as little as 5% of the outstanding balance. They can defer the unpaid money to the following month’s billing cycle.

- Credit Card Shield (Takaful): This ADCB credit card protects the cardholder in the event of a serious sickness or permanent incapacity, involuntary job loss, or natural death. To be eligible for these benefits, the cardholder must participate in the Takaful programme and pay a monthly fee of 1.0395 percent of the total outstanding balance. The maximum amount of coverage available is AED 100,000.

- Misuse Protection: The cardholder can safeguard their card from fraudulent or illegal transactions, as well as illegal third-party usage. celebrations

- Purchase Protection: The cardholder is entitled to free purchase protection on items purchased with this ADCB Credit Card, which is valid for 365 days from the date of purchase. It protects you against the loss or theft of your belongings, as well as accidental damage.

- Extended Warranty: The cardholder can get a one-year extended manufacturer’s or retailer’s warranty on items purchased with this credit card.

- Easy 0% Profit Payment Plan for 48 Months: This ADCB Credit Card allows the customer to break their transactions into simple zero percent profit payment plans (maximum).

- Amount Transfers: Cardholders can effortlessly transfer their outstanding balance from another bank’s credit card to this ADCB credit card without incurring any interest.

- Loan: The bearer of this ADCB credit card can receive cash against their available credit limit with a pay order. They have the option of repaying the loan in convenient payments over a period of up to 48 months.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days. today’s date

- 0% Interest on School Fee Payments: The cardmember may divide their child’s school fee payment into convenient payments of up to 12 months at 0% interest and a small processing fee.

ADCB Etihad Guest Platinum Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 525 |

| Minimum Salary | AED 15,000 |

| FX Rate | 2.99% |

Features & Benefits

- Sign-up Incentive: The ADCB Etihad Guest Platinum Credit Card gives 12,000 Etihad Guest Miles as a sign-up incentive throughout the first year of card membership.

- Etihad Guest Miles: For local transactions, the cardholder can earn 1 Etihad Guest Mile. When customers use the card for Etihad Airways transactions as well as overseas transactions, they get 1.25 Etihad Guest Miles.

- Monthly Bonus: Cardholders will get 1,000 Etihad Guest Miles as a monthly bonus when their monthly transactions total USD 1,000 or more.

- Travel Bonus: Members of this credit card may take advantage of a variety of travel benefits, including:

- 3 complimentary airport lounge passes valid at over 1000 airport lounges.

- On Agoda reservations, you may get up to a 12% discount.

- Hotels.com is offering an 8% discount.

- Visa’s luxury hotel selection has a number of advantages.

- Lifestyle Advantages: The following are some of the top lifestyle benefits offered by this ADCB credit card:

- MENA app provides a variety of 2 for 1 deal.

- Yas Island Adventure Parks provides exclusive deals and benefits.

- A maximum of 30% off at over 1400 restaurants in the UAE, as well as unique shopping, travel, and entertainment deals.

- ADCB Mobile App: This official mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using just their mobile phones.

- Purchase Protection: The cardholder is entitled to free purchase protection on items purchased with the ADCB Credit Card, which is valid for 365 days from the date of purchase. It protects you against the loss or theft of your belongings, as well as accidental damage.

- Extended Warranty: On different items purchased with this credit card, the card holder can get an extended manufacturer’s or retailer’s warranty for up to a year.

- Credit Card Shield: The cardholder is covered by this ADCB credit card in the event of a serious sickness or permanent disability, involuntary job loss, or even natural death. To take use of these advantages. The cardholder must enlist in the Takaful programme by paying a monthly fee of 1.0395 percent of the total outstanding balance.

- Easy Instalments: With this ADCB Credit Card, you may break your transactions into a Profit Payment Plan with low interest rates and durations up to 48 months. Payments can be paid in instalments at partner merchants with no interest and a nominal processing fee.

- Credit Transfers: Card members may effortlessly transfer their outstanding balance from another bank’s credit card to this ADCB credit card at no interest and repay over a 48-month period in low-interest payments.

- Loan: With this ADCB credit card, the cardholder can take out a credit card loan against their available credit limit. They have the option of repaying the loan in 48 monthly payments.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days. today’s date

- 0% Interest on School Fee Payments: The cardmember may divide their child’s school fee payment into convenient payments of up to 12 months at 0% interest and a small processing fee.

ADCB Touchpoints Infinite Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 1,050 (AED 525 for Excellency members) |

| Minimum Salary | AED 40,000 |

| FX Rate | 2.99% |

Features & Benefits

- BOGO offers at VOX theatres are available to cardholders.

- Advantages of a Healthy Lifestyle: This credit card comes with a variety of lifestyle perks, such as:

- Free two-night stays in a variety of hotels throughout the world

- At U by Emaar, you may get a free Platinum membership.

- Caribou Coffee has BOGO deals.

- Talabat orders receive a 20% discount.

- noon.com is offering a 15% discount.

- Careem offers a 50% discount on weekend rides.

- Noon.com is offering a 15% discount.

- Yas Island Adventure Parks provides exclusive deals and benefits.

- Global concierge services are available 24 hours a day, 7 days a week for free golf access.

- MENA app provides a variety of 2 for 1 deal.

- Benefits of Travel: The cardholder has free unrestricted access to more than 850 airport lounges in more than 850 destinations around the world. They may also take advantage of Agoda’s accommodation savings, a free airport chauffeur, and Dragon Pass Dine and Fly’s airport dining offerings.

- Visa Benefits: This Visa card lets you enjoy various attractive lifestyle experiences and privileges from dining to golf to shopping and many others.

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Minimum Payment Due: Every month, the cardholder can pay as little as 5% of the outstanding balance. They can defer the unpaid money to the following month’s billing cycle.

- Simple Instalments: With this ADCB Credit Card, you may break your transactions into a simple Profit Payment Plan for up to 24 months (maximum) at low interest rates. Additionally, purchases made through the bank’s extensive partner network can be paid back in instalments with no interest costs.

- Balance Transfer: By moving outstanding balances from other banks’ credit cards to this ADCB credit card, the cardholder can save money on interest. They may also take advantage of the 0% interest rate and repay in convenient monthly instalments for a maximum of 12 months.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days. today’s date

- Debit Instructions: The cardholder can set up automatic debit instructions for payments to be made from their checking or savings account.

- Loan: With this credit card, the cardholder can receive cash against their available credit limit using the ADCB credit card loan facility. Within three working days, the funds will be deposited to their bank account, and they will be able to repay the loan in convenient 12-month payments.

- School Fee Payments: The cardholder may use this ADCB credit card to convert their child’s school and college expenses into monthly repayments with no interest for up to 12 months.

- Misuse Protection: The cardholder can safeguard their card from fraudulent or illegal transactions, as well as the usage of their card by unwelcome third parties.

- Credit Shield: For a small monthly cost, cardholders can purchase credit shield, which protects their outstanding amount up to AED 200,000 in the event of serious sickness, permanent complete disability, natural death, or involuntary job loss.

- Multi-Trip Travel Coverage: With this credit card, the ADCB includes a complimentary multi-trip travel cover that covers the cardholder and their family on domestic and foreign journeys for up to 90 days.

- Reward Program for TouchPoints: The cardholder may earn 1.5 TouchPoints for every AED spend with this ADCB TouchPoints Credit Card. When they spend AED 15,000, they will earn 15,000 TouchPoints as a bonus every month.

ADCB Touchpoints Platinum Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 630 (free for 1st year) |

| Minimum Salary | AED 15,000 |

| FX Rate | 2.99% |

Features & Benefits

- BOGO offers at VOX theatres are available to cardholders.

- Lifestyle Perks: This credit card comes with a variety of lifestyle perks, including:

- Talabat orders receive a 20% discount.

- Yas Island Adventure Parks provides exclusive deals and benefits.

- Access to the golf course is free.

- MENA app provides a variety of 2 for 1 deal.

- Travel Benefits: Cardholders get free unrestricted access to airport lounges in many destinations around the world, as well as savings on hotel bookings through Agoda, a free airport chauffeur, hotel and airline savings through Cleartrip & MasterCard, and access to airport dining options with Dragon Pass Dine and Fly.

- Benefits from Visa and MasterCard: With this credit card, you may take advantage of a variety of Visa and MasterCard enticing lifestyle experiences and perks, including eating, golf, shopping, and more.

- Purchase Protection & Extended Warranty: The cardholder can get purchase protection on items purchased with this TouchPoints card. It protects you against the loss or theft of your belongings, as well as accidental damage.

- Credit Card Shield (Takaful): The cardholder and their family are covered by this ADCB credit card in the event of severe sickness or permanent incapacity, involuntary job loss, or even natural death. To be eligible for these benefits, the cardholder must participate in the Takaful programme and pay a monthly fee of 1.0395 percent of the total outstanding balance. The highest amount of coverage available is AED 200,000.

- Loan: With this credit card, the cardholder can receive cash against their available credit limit using the ADCB credit card loan facility. Within three working days, the funds will be deposited to their bank account, and they will be able to repay the loan in convenient 12-month payments.

- Balance Transfer: By moving outstanding balances from other banks’ credit cards to this ADCB credit card, the cardholder can save money on interest. They may also benefit from the flexibility of a 0% interest rate and repay in convenient monthly payments of up to 12 months.

- Easy Instalments: With this ADCB Credit Card, you may break your transactions into an easy Profit Payment Plan for up to 24 months (maximum) at low interest rates. Additionally, purchases made through the bank’s extensive partner network can be paid back in instalments with no interest costs.

- School Fee Payments: The cardholder may use this ADCB credit card to convert their child’s school and college expenses into monthly repayments with no interest for up to 12 months.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days.

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Minimum Payment Due: Every month, the cardholder can pay as little as 5% of the outstanding balance. They can defer the unpaid money to the following month’s billing cycle.

- Debit Instructions: The cardholder can set up automatic debit instructions for payments to be made from their checking or savings account.

- TouchPoints Reward Program: The cardholder may earn 1 TouchPoint for every AED spent with this TouchPoints Credit Card. Every time they spend AED 10,000, they will earn 10,000 TouchPoints as a bonus.

ADCB Touchpoints Titanium/Gold Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 0 |

| Minimum Salary | AED 8,000 |

| FX Rate | 2.99% |

Features & Benefits

- BOGO offers at VOX theatres are available to cardholders.

- Lifestyle Perks: With the ADCB Titanium Credit Card, the cardholder may take advantage of a variety of lifestyle benefits, including:

- Yas Island Adventure Parks provides exclusive deals and benefits.

- There are several dining options available.

- MENA app provides a variety of 2 for 1 deal.

- Benefits of Travel: The cardholder has free unrestricted access to airport lounges in numerous places around the world. They may also take use of Careem’s complimentary airport chauffeur service.

- Benefits from Visa and MasterCard: With this credit card, you may take advantage of a variety of Visa and MasterCard enticing lifestyle experiences and perks, including eating, golf, shopping, and more.

- Loan: With this credit card, the cardholder can receive cash against their available credit limit using the ADCB credit card loan facility. The money will be deposited to their bank account within three working days, and they can return the loan in up to twelve convenient payments.

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Balance Transfer: By moving outstanding balances from other banks’ credit cards to this ADCB credit card, the cardholder can save money on interest. They may also benefit from the flexibility of a 0% interest rate and repay in convenient monthly payments of up to 12 months.

- Easy Instalments: With this ADCB Credit Card, users may break their transactions into a simple 0% profit payment plan for up to 24 months (maximum) at low interest rates. In addition, while purchasing at partner merchants, the instalments can be paid off with no interest.

- School Fee Payments: The cardholder may use this ADCB credit card to convert their child’s school and college expenses into monthly repayments with no interest for up to 12 months.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days.

- Minimum Due Amount: Every month, the cardholder can pay as little as 5% of the outstanding balance. They can defer the unpaid money to the following month’s billing cycle.

- Debit Instructions: The cardholder can set up automatic debit instructions for payments to be made from their checking or savings account.

- Security: This ADCB credit card provides security for the cardholder and their family in the event of serious sickness or permanent incapacity, involuntary job loss, or even natural death. To be eligible for these benefits, the cardholder must participate in the Takaful programme and pay a monthly fee of 1.0395 percent of the total outstanding balance. The highest amount of coverage available is AED 200,000.

- TouchPoints Reward Program: The cardholder may earn 0.75 TouchPoints for every AED spend with this TouchPoints Credit Card.

ADCB LuLu Platinum Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 0 |

| Minimum Salary | AED 15,000 |

| FX Rate | 2.99 % |

Features & Benefits

- Free Airport Lounge Access: The cardholder is entitled to unlimited free airport lounge access at over 25 local and international airport lounges located across the world.

- Extra Amusement Park Benefits: Card members may earn up to 15% off general admission tickets and passes purchased at the park ticket counters, 10% off food and beverages, 15% off merchandise, and complimentary fast passes worth AED 150 for expedited access to ticket counters at Ferrari World Abu Dhabi, Warner Brothers World Abu Dhabi, and Yas Waterworld Abu Dhabi.

- Buy 1 Get 1 Offer: Throughout the Middle East and Africa, this ADCB credit card provides hundreds of Buy 1 Get 1 discounts on gourmet restaurants, luxury spas, and much more.

- Careem Rides: Each month, cardholders may get a 20% discount on three Careem rides. They must use the promo code MASTERCARD at the time of booking to qualify for this deal.

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days.

- Minimum Due Amount: Every month, the cardholder can pay as low as 5% of their outstanding balance. They can defer the unpaid money to the following month’s billing cycle.

- Balance Transfer with No Interest: This service is be to obtained within 90 days after card registration, with the option of making simple repayments over a period of 24 months (maximum).

- Loan: Via this credit card, the cardholder can receive cash against their available credit limit with a pay order using the ADCB credit card loan facility. The loan can be repaid over a period of up to 24 months in convenient payments.

- Instalment plans: With this credit card, you may break your transactions into an easy 0% profit payment plan for up to 24 months (maximum) at low interest rates. Additionally, payments can be made at a 0% interest rate while purchasing at partner stores.

- LuLu Points: The cardholder can earn up to 5 LuLu points for every AED spent at a LuLu store using the ADCB Credit Card. They may earn 1.25 LuLu points for every AED spent on other purchases. By simply showing the LuLu credit card at the LuLu Hypermarkets’ checkout counters, LuLu Points may be redeemed for as little as 5,000 points with both primary and auxiliary cards.

- Credit Shield: For a small monthly cost, the card offers an optional insurance coverage that protects the card’s outstanding balance up to AED 200,000 against unforeseen events such as severe sickness, permanent complete disability, natural death, and involuntary loss of job.

ADCB LuLu Titanium Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 0 |

| Minimum Salary | AED 8,000 |

| FX Rate | 2.99 % |

Features & Benefits

- Complimentary Lounge Access: The cardholder is entitled to complimentary airport lounge access at about 10 locations in the Middle East, including the United Arab Emirates, Egypt, Saudi Arabia, Kuwait, and Jordan.

- Extra Amusement Park Benefits: Card members may earn up to 15% off general admission tickets and passes purchased at the park ticket counters, 10% off food and beverages, 15% off merchandise, and complimentary fast passes worth AED 150 for expedited access to ticket counters at Ferrari World Abu Dhabi, Warner Brothers World Abu Dhabi, and Yas Waterworld Abu Dhabi.

- Buy 1 Get 1 Offer: Throughout the Middle East and Africa, this ADCB credit card provides hundreds of Buy 1 Get 1 discounts on gourmet restaurants, luxury spas, and much more.

- Careem Rides: Each month, cardholders may get a 20% discount on three Careem rides. They must use the promo code MASTERCARD at the time of booking to qualify for this deal.

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days.

- Minimum Due Amount: Each month, the cardholder can pay as low as 5% of their outstanding balance. They can defer the unpaid money to the following month’s billing cycle.

- No Interest Balance Transfer: This function is available within 90 days after card registration, and it comes with the option of making simple payments over a 24-month period (maximum).

- Loan: With this credit card, the cardholder can receive cash against their available credit limit using the ADCB credit card loan facility. The loan can be repaid over a period of up to 24 months in convenient payments.

- Instalment plans: With this credit card, you may break your transactions into an easy 0% profit payment plan for up to 24 months (maximum) at low interest rates. Additionally, these payments can be reimbursed at a 0% interest rate while buying at partner merchants.

- Credit Shield: For a small monthly cost, the card offers an optional insurance coverage that protects the card’s outstanding balance up to AED 200,000 against unforeseen events such as severe sickness, permanent complete disability, natural death, and involuntary loss of job.

- LuLu Points: For every AED spent at a LuLu store, the cardholder can earn up to 3.5 LuLu points with the ADCB Credit Card. They can earn 1 LuLu point for every AED spent on other purchases. By simply showing the LuLu credit card at the LuLu Hypermarkets’ checkout counters, LuLu Points may be redeemed for as little as 5,000 points with both primary and auxiliary cards.

ADCB Betaqti Credit Card

| Your Retail Interest/month | 2.5 % |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 2100 |

| Minimum Salary | AED 5,000 |

| FX Rate | 0 % |

Features & Benefits

- Rewards

- Welcome Incentive: As a welcome bonus, the cardholder will receive 300,000 TouchPoints.

- Daily Rewards: For every AED paid, the cardholder can earn 3 TouchPoints.

- Anniversary Rewards:

- 750,000 TouchPoints for an annual expenditure of AED 500,000

- 500,000 TouchPoints for an annual expenditure of AED 350,000

- 250,000 TouchPoints for an annual expenditure of AED 250,000

- Advantages of a healthy lifestyle: With this card, the cardholder may take use of a variety of lifestyle benefits and privileges, including:

- VOX Cinemas, including the Rhodes Theatre, are offering a Buy One, Get One Free movie ticket deal. A 20% discount is also available on a limited number of meals.

- All Gold’s gym clubs in the UAE are free to use.

- U by Emaar Platinum tier membership is provided free of charge.

- Caribou Coffee has BOGO deals.

- Yas Island Theme Parks & Attractions provide exclusive privileges.

- Global concierge services 20% off Careem rides three times a month Wide selection of exclusive privileges at The Coffee Club, Mandoos, Jumeirah at Etihad Towers, The Regis Abu Dhabi, and others

- Benefits of Traveling: This ADCB credit card comes with the following travel benefits:

- Free access to over 1000 airport lounges around the world

- Hertz is a member of the President’s Circle.

- At selected Marriott Bonvoy Hotels, you can get free nights.

- Avis offers up to a 25% discount on all rentals.

- Travel insurance that covers everything

- Benefits and advantages of a high-end hotel

- MasterCard World Elite Benefits: With their ADCB card, Betaqti cardholders may take advantage of unique MasterCard World Elite Benefits.

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Easy 0% Profit Payment Plan with Low Interest Rates for 24 Months: This ADCB Credit Card allows the customer to break their transactions into simple 0% Profit Payment Plans with Low Interest Rates for 24 Months (maximum). Additionally, when purchasing with the partners, you may make instalment payments at a 0% interest rate.

- Amount Transfers: Cardholders can effortlessly transfer their outstanding balance from another bank’s credit card to this ADCB credit card without incurring any interest.

- Loan: The user can receive cash against their available credit limit with this ADCB credit card. They can pay back the money in convenient instalments over a period of up to 24 months.

ADCB Traveler Credit Card

| Your Retail Interest/month | 3.25% |

| Balance Transfer Facility | Yes |

| Cashback Facility | No |

| Annual Membership Fee | AED 1050 |

| Minimum Salary | AED 30,000 |

| FX Rate | 0 % |

Features & Benefits

- Free entry: Free entry to a variety of golf clubs, including The Track Meydan Golf Dubai, Yas Links Golf Club Abu Dhabi, and Arabian Ranches Golf Club, is available to card members.

- Buy one, get one free: Hundreds of free offerings are available to cardholders around the Middle East and Africa, including great dining places, luxury spas, and much more.

- Minimum Due Amount: Every month, the cardholder can pay as low as 5% of their outstanding balance. They can defer payment of the outstanding sum until the following month’s billing cycle.

- Loan: With this credit card, the cardholder can receive cash against their available credit limit using the ADCB credit card loan facility. The loan may be paid back in simple instalments over a period of up to 24 months at a low interest rate.

- Credit Shield: For a small monthly cost, the card offers an optional insurance coverage that covers the card’s outstanding amount for up to AED 200,000 in the case of a serious illness, permanent complete disability, or natural death.

- Balance Transfer with No Interest: This function, as well as the flexibility, may be obtained within 90 days following the card’s registration of making simple repayments for a period of 24 months (maximum).

- Instalment Plan: With this ADCB Credit Card, you may break your transactions into an easy 0% profit payment plan for up to 24 months (maximum) at no interest. In addition, while purchasing at partner merchants, the instalments can be repaid with no interest.

- Free Hotel Stays: With a minimum annual spend of AED 150,000, the cardholder is eligible for up to 6 complimentary hotel stays. In addition, as a sign-up incentive, members of this travel credit card will receive a two-night complimentary hotel stay voucher.

- Free Access to Over 900 Premium Airport Lounges: Members of this ADCB credit card have unrestricted free access to over 900 premium airport lounges worldwide.

- Discounts on Air Tickets and Hotel Bookings: This ADCB credit card entitles the bearer to a 20% discount on flight tickets made via Cleartrip. They may also save 20% on hotel reservations if they book via hotels.com.

- Discount on Careem Rides: Three times a month, card members can receive a 20% discount on Careem Rides.

- Travel Insurance: This ADCB credit card offers complimentary travel insurance to cardholders.

- Starwood Resorts & Hotels: Benefits of the ADCB credit card include discounts at Starwood Resorts and Hotels. The cardholder can book two nights and receive the third night free.

- No Foreign Currency Fees: When using this travel card overseas, ADCB does not impose any fees.

- ADCB Mobile App: The official ADCB mobile app allows cardholders to manage and regulate transactions as well as set spending restrictions using their mobile phones.

- Interest-Free Period: If the cardholder pays their debt in full on or before the due date, they can enjoy an interest-free period of up to 55 days.

- Extra Amusement Park Benefits: Card members may earn up to 15% off general admission tickets and passes purchased at the park ticket counters, 10% off food and beverages, 15% off merchandise, and complimentary fast passes worth AED 150 for expedited access to ticket counters at Ferrari World Abu Dhabi, Warner Brothers World Abu Dhabi, and Yas Waterworld Abu Dhabi.