A Tax Registration Number (TRN) is a unique identification number for all of the tax documents and records that need to be filed by the government. The TRN is assigned to each individual upon submission of tax returns and it is mandatory to maintain it. Every business that deals with cash or goods for sale should be registered under the Income Tax Act.

Every business that has been registered under the Income Tax Act must forward to the Ministry of Finance UAE the details of its annual income and expenditure along with the tax returns filed. The same information is forwarded to the Central Board of Excise and Customs.

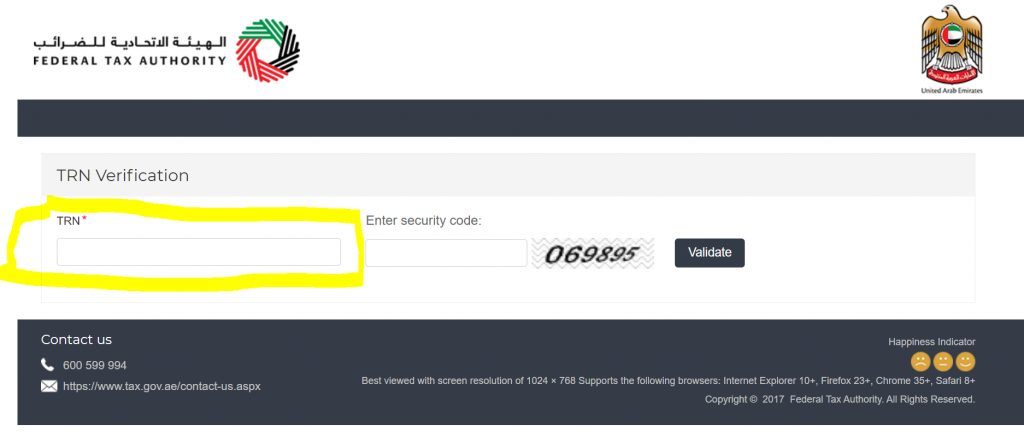

How to verify TRN online in UAE?

To verify Tax Registration Number (TRN) you simply need to follow these steps.

- Go to the official website of Federal Tax Authority by clicking here

- Enter your TRN number and the security code that is shown in the image.

And now final you need to click on Validate.

The Central Board of Excise and Customs

The Central Board of Excise and Customs is an executive body of the Government of UAE. It maintains and implements the customs regulations. By forwarding all the relevant tax returns, the Central Board of Excise and Customs is able to monitor and control the flow of taxable goods.

Every business is required to submit tax returns to the Board of Excise and Customs. These returns are available for viewing online. If a company wants to avail the benefits of exemption on import, then they should forward their tax registration number to the Board of Excise and Customs.

The Central Board of Excise and Customs issues stamps of approval or denial for imported articles. If any tax payment is not received on the goods imported into the country, then the importer is legally required to repay the amount to the tax office.

Failure to return the stamp of approval within the prescribed time causes immediate cancellation of the permit to import.

The Central Board of Excise and Customs issues a tax registration number to individuals or companies that import taxable goods for sale. The tax registration number is issued to the importer based on the date of issue of the tax returns.

What should importers do before the expiry of the prescribed time?

The importer should forward to the Board of Excise and Customs their tax registration number before the expiry of the prescribed time.

The importer must also pay the prescribed duty and tax on the goods that have been imported. When you import goods, you are required to pay all taxes on them at the same time. The importer needs to make sure that he/she pays the appropriate tax on the goods brought into the country. Failure to do so can result in a fine that amounts to a large amount.

Import goods for commercial use.

An important point that is to be kept in mind is that goods imported into the country do not become taxable unless they are imported for commercial purposes. Goods imported for personal use cannot be taxed. The importer needs to remember this fact before submitting their tax registration number. Otherwise, the importer may have to pay a fine for submitting the incorrect tax registration number. The importer needs to pay the tax on the goods brought into the country and not on the goods that were imported for personal use.

There are two ways in which the importer can submit the required tax on the imported goods.

- They can either pay the tax upfront or pay it after the expiry of the prescribed period. However, if the importer wants to pay it after the expiry of the prescribed time, then he/she should contact the customs immediately after the expiry of the time and request for a refund.

- The importer must ensure that the refund is paid on time or face severe penalties. Failure to pay the refund in time will also lead to the cancellation of the customs clearance.

What should you do to avoid problems in TRN?

In order to avoid problems with the tax department, it is best for importers to export goods in bulk. This way, they will be able to reduce their tax payments on every item that is being transported. If the importer is unsure about how to do it, he/she can seek professional help from the concerned tax department.

How is responsible for TRN?

It is important for the importer to keep in mind that the importer is responsible for paying the tax on the goods transported even if it has been exported in bulk. Therefore, care should be taken to follow all the regulations regarding tax registration number and payment of taxes.

A beneficial value addition tax identification number or VAT number is an official identifier usually issued by the government of UAE. In this regard, it differs from a country’s social security number or national ID card.

Both are official means of identifying a person. While the social security number is considered as a legal proof of identity, the VAT id number has not been granted yet.

What is VAT?

In the past, the VAT registration number was actually a series of alphanumeric characters. It had no meaning or use other than to facilitate bookkeeping and tax collection in the European Union.

Now, all UAE member states use the same system, which is the VAT number. This id is exclusively for use in the internal market for sales, purchases, and production and consumption of services.

Aside from the legal implications, businesses have practical reasons for having a VAT identifier. By having this, they will be able to track their sales, purchase, receipts, and so on. With this, they can easily trace back the activities of their business clients and other related parties. This is especially useful for auditing purposes as well as tax audits.

Why VAT is important?

In some cases, business owners and individuals also use the VAT number to register their products or items with the government.

For instance, food, drinks, flowers, plants, etc. are all considered merchandise or items that fall under the jurisdiction of a certain country or region. Through the use of a VAT registration number, business owners and individuals can easily indicate which product or item falls under a particular tax rate. The value of this registration number varies according to the country or region where the business holds its registration.

Basically, any entity that has transactional or fiscal relationships with the government must undergo a tax registration number. In most cases, businesses register for both types of documents at the same time. Businesses are often required to submit their tax registration numbers to the local authorities for evaluation.

This means that when these entities undergo annual tax assessments, they need to provide the appropriate identification number to the concerned authority. Similarly, when people engage in financial transactions or exchanges of contracts with one another, they must also provide proof of their tax registration numbers.

What is tax id number/TRN Verification?

Tax id numbers are used by both parties involved in the transaction or exchange. The government will use the appropriate identification number while a business uses its own individual tax registration number. It is very important that both parties comply with their tax records and regulations.

Transactions between business establishments may involve payments and receipt of income, sale of goods and services, and transfer of ownership among other things. Thus, it is very important that businesses and individuals pay their due taxes and remain on the good books of the country or region where they do business.

In fact, it is very easy for people to forget about their legal obligations and liabilities when they are dealing with one another only informally.

However, this informal system of tax payment can cause serious consequences for the business owner if he/she does not remember to file tax returns or pay their corresponding taxes and penalties. Failing to remember or honor a tax registration number may cause tax penalties and fines.

Thus, keeping track of tax registration numbers and reporting to the concerned authorities will save a business from all kinds of complications.

Keep save your business accounting records.

It is always important to keep a close eye on a business’s accounting records. It is also advisable to ask for the tax registration number of a business before doing any kind of debit or credit to or from the business.

By so doing, it will become easier to know the exact amount of taxes and penalties that the business owes to the government. A business owner should also keep a record of all correspondence that he/she has had with the concerned government agencies in the past years.

This will help him/her easily find out how much tax has been paid or what tax amount is due.

Why TRN plays an important role while buying or selling?

If you want to purchase a piece of real estate, it would be helpful if you will know the tax registration number or VTR. This is a special identification number that is used to make sure that the property that is being sold complies with the law. The most common uses for this number are for sales and purchases.

There are other reasons why it is important to have this number but these are the most common ones.

- First, this tax registration number will be needed by the local government when it is time to purchase, sell, or transfer property. The best time to get your registration number is during the bidding process so the buyer will have to provide this information.

- This is also the time when the buyer will ask for his or her own tax identification number or CVT. After all, the seller needs to know what is going on with this sale so there is no point in wasting time registering the property if the buyer does not have his or her own tax identification number. This is also one of the ways that the government uses to check on the ownership of properties that are part of public records.

- When you get a resell certificate from the government, it is also a good idea to have your own tax registration number or VTR. The reason for this is simple. When the owner of a resell certificate wants to change the buyer’s address, he or she needs to update the resell certificate.

- The buyer might not remember all of the things that were put on the list but he or she will surely remember his or her own tax identification number or CVT. So even if the buyer’s address has been changed, the seller can still legally do business using the same resell certificate.

- Tax Registration Number or VTRs are also used to register a new business. If the business is not yet registered, then the proprietor needs to go through the process of registering it as a legal business.

When he or she has already registered the business and wishes to apply for a tax ID, then he or she can simply use his or her VTR. He or she will also be able to get his or her VAT number which is the tax identification number that is linked with the tax registration number.

How Taxation authorities give out different business registration numbers?

Taxation authorities give out different business registration numbers or VCTs depending on the different transactions that are done in a certain period of time. For instance, if someone buys a property or shares some assets from you, he or she will need to inform the authorities about his or her name, age, sex, tax registration number and other information.

After submission, he or she will be given his or her business incorporation number or TCN. If he or she intends to change his or her name, he or she will need to inform the exchange commission and after a few months, they will transfer the registration number of the person to the TCN of the new name.

After a while, another TCN will be issued to the person with the new name for a full business incorporation and the new business registration number as well.

In addition to this, people who own real estate can have their name, addresses, mortgages, ownership and occupancy details entered in the database of the Czech Republic Property Registry by paying a small amount of money as registration fees.

Also Read: Top 5 computer monitoring software in 2021

Documents required for TRN Verification.

However, before getting a certificate from the register, they should ensure that they have obtained all the necessary legal documents that pertain to their property such as

- Their original property titles.

- Deeds.

- Mortgages.

- Liens and encumbrances.

Aside from the real estate documentations, they should also provide additional personal information like their social security number, their residence or domicile, their driving license and any other tax identification number.

They will also need to present a copy of their birth certificate if they are above eighteen years old. And if they are not resident of the Czech Republic, they should also present a copy of their birth certificate.

The next option available is the sole commercial registry number. This option is for people who register with the Companies House in the UAE. To use this option, they must pay a nominal fee.

There is no need to get a new tax registration number nor do they have to change their personal details. But if they wish to continue using the personal details they have at present, they may register with the CCJ’s Register of UAE.

Conclusion

People who wish to purchase commercial real estate in the republic need to use the sole commercial registry number. However, this option is usually applicable for individuals who are residents of the UAE.

As long as they have not acquired the citizenship of the Czech Republic, they will be allowed to register with the commercial register number of the republic.

If they wish to change their residential address or their domicile in the UAE, they will be required to obtain a new UAE tax identification number or an ETR number from the UAE tax authorities.